For Businesses

Streamline your KYC processes with our secure and decentralized solution. Reduce compliance costs and enhance user experience. Click here to explore our tailored services for businesses.

For Users

Control your digital identity with our decentralized solution. Share selectively, earn rewards, and manage your credentials securely.

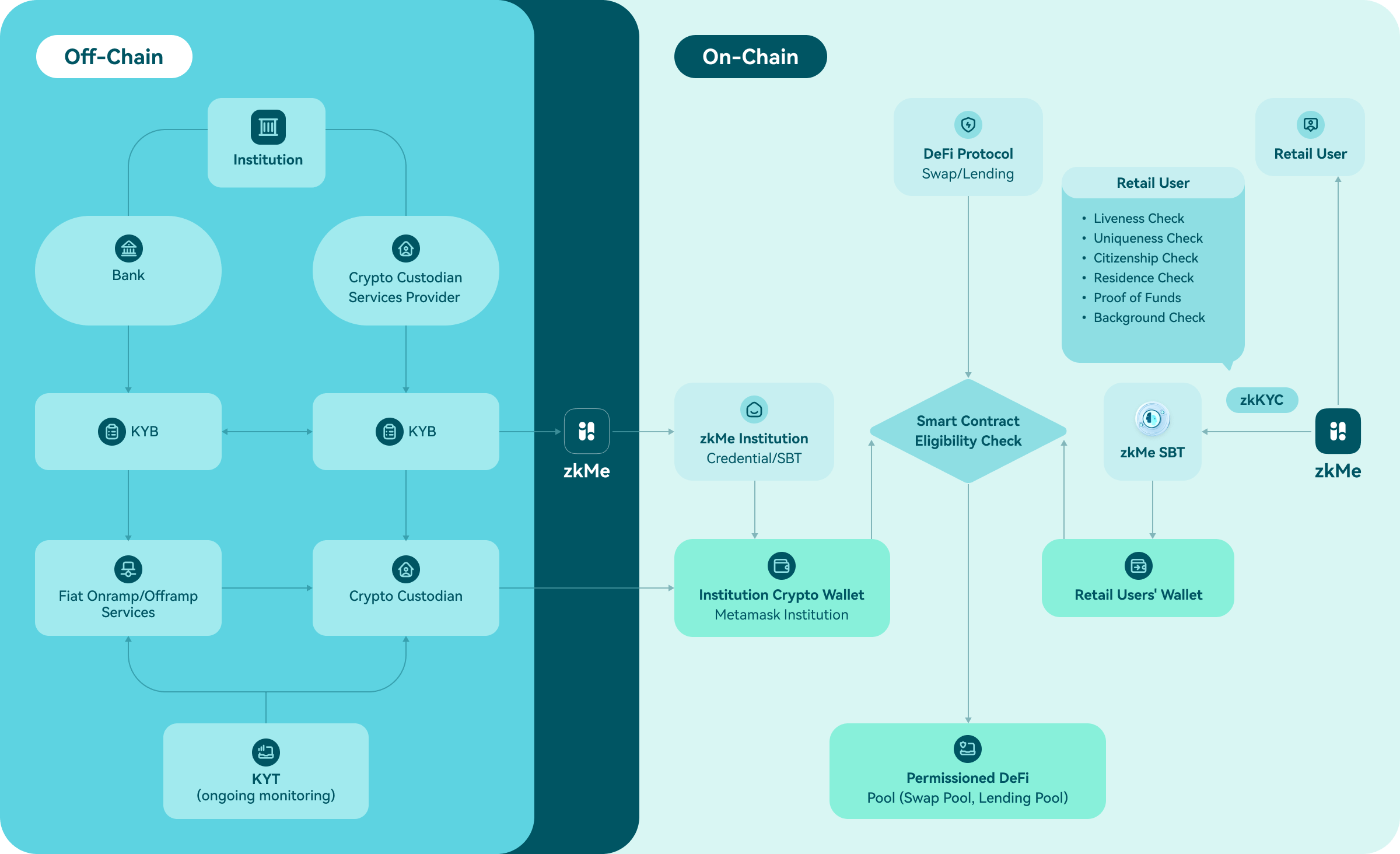

Bring Institutions to DeFi

By integrating zkMe's zkKYC solution, permissioned DeFi can bring institutions into the DeFi market while ensuring compliance with relevant laws and regulations.

What is Permissioned DeFi?

Permissioned DeFi is a type of decentralized finance that requires permission to access. It is used by institutions and corporations to control their financial activities on the blockchain.

To gain access to the network, users may need to complete Know Your Customer (KYC) or Know Your Business (KYB) procedures. These procedures verify the identity of users and ensure compliance with relevant laws and regulations, preventing fraud, money laundering, and other illicit activities.

Permissioned DeFi is a type of decentralized finance that requires permission to access. It is used by institutions and corporations to control their financial activities on the blockchain.

To gain access to the network, users may need to complete Know Your Customer (KYC) or Know Your Business (KYB) procedures. These procedures verify the identity of users and ensure compliance with relevant laws and regulations, preventing fraud, money laundering, and other illicit activities.

Benefits for Diffident Domains

Institutions

Yields generation

Permissible DeFi enable institutions to comply with KYB and KYC regulations while still benefiting from yield-generating opportunities in the DeFi market.

Banks

Deposit taking

Permissioned DeFi can provide deposit-taking capabilities, allowing institutions to easily move funds in and out of the system.

Custodian

Revenue generation

Custodians offer physical vaults, cold storage, multi-signature wallets, and insurance coverage to securely manage cryptocurrency funds, and expand their client base and increase revenue streams.

DeFi protocols

Liquidity taking

DeFi protocols can benefit from permissioned DeFi systems by taking liquidity from institutions and corporations.

zkMe

zkKYC service provider

zkMe generates credentials for counterparties, and only whitelisted wallet addresses can participate in permissioned DeFi pools. This allows for greater control over financial activities on the blockchain while still providing access to the benefits of decentralized finance.

Retail users

Yields generation

Retail users can participate in permissioned DeFi pools by providing liquidity and generating yields.

Why choose zkMe zkKYC solution?

Privacy first

Full security

Fulfil compliance requirement

Seamless integration

Decentralised

Reuseable zkKYC

How does it work?

zkMe App / widget

Facial recognition / document OCR

Raw document file threshold encryption

ZKP generation

SBT minting

SBT verification

zkKYC

zkKYC Use Cases